Daily Dividend Investor Update

To my loyal Daily Dividend Investor readers: Please note that I have migrated the site over to a managed server located at: www.dailydividendinvestor.com

I will continue to update this WordPress site with duplicate content for a few weeks, but you may want to check in at my new hosted location for all the latest content. I am also using a better – easier to read theme that I hope you’ll enjoy. Thanks for reading and following along and don’t forget to LIKE our Facebook page!

Thanks!

Neil

Dividend Increases for the week of December 12, 2011

With th is update of stocks increasing their dividend, I’ve gone to a new and improved, weekly format.

is update of stocks increasing their dividend, I’ve gone to a new and improved, weekly format.

I was finding that writing a report everyday for the stocks with dividend increases was a lot to keep up with. Often times there would be stocks with minimal increases, but nothing really meaningful to add about those increases or the companies behind them.

Since the Daily Dividend Investor portfolio isn’t about day trading, the information presented is just a valuable on a weekly basis as on a daily basis.

Actually, I think being able to scan the list of *all* the increases for the week is more valuable – allowing the reader to quickly process more possible investment ideas in a shorter amount of time.

I hope you enjoy the new format!

The weekly wrap

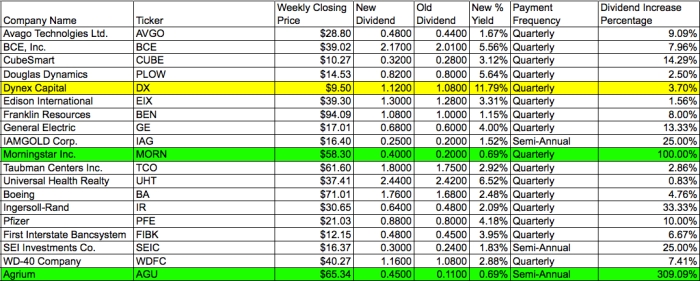

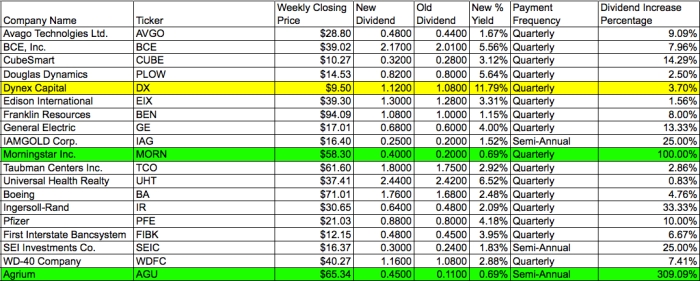

There were a total of 38 stocks that increased their dividend this week including 5 that already make up the Daily Dividend Investor portfolio. With the new format I have highlighted the top two stocks with the highest dividend increase in green as well as highlighting the two stocks with the highest overall yield in yellow.

I should caution you as always, that because a stock is highlighted does not mean you should add it to a buy list, my intent is to simply point out those stocks with unique characteristics for your review.

The stocks with dividend increases this week spanned a broad spectrum of industries from Hotels (Host Resorts – ticker: HST), Real Estate (Realty Income – ticker: O), Pharmaceuticals (Pfizer – ticker: PFE) to Utilities (Edison International – ticker: EIX) and Financial Services (Discover – ticker:DFS)

The DDI Portfolio Organic Growth

The Daily Dividend Investor portfolio saw increases in five of it’s current holdings:

The Daily Dividend Investor portfolio saw increases in five of it’s current holdings:

- Edison International – ticker: EIX

- General Electric – ticker: GE

- Pfizer – ticker: PFE

- Nucor – ticker: NUE

- Realty Income – ticker: O

When choosing new additions for the DDI portfolio, dividend growth is one of the key factors I consider, so it’s good to see the holdings not just pay a dividend but increase it as well. The percentage increases ranged from .2% up to 13% across these five holdings.

Top Producers

This week’s top producers included two high-yielders in the 8-12% range. Dynex Capital (ticker: DX) with a new payout of $1.12/share yielding 11.2%  and Atlantic Power (ticker: AT) paying $1.14/share and a yield of 8.46%. If you’re looking to diversify with a Canadian holding that also pays out monthly you may want to dig a little deeper with Atlantic Power.

and Atlantic Power (ticker: AT) paying $1.14/share and a yield of 8.46%. If you’re looking to diversify with a Canadian holding that also pays out monthly you may want to dig a little deeper with Atlantic Power.

While there may be some tax withholding implications for investors outside of Canada, the above average monthly payout makes Atlantic Power a compelling story.

For those looking more at total dividend growth over absolute return, we had two homeruns this week. Morningstar (ticker: MORN) had a 100% increase taking their annual dividend from $.20 to $.40/share. Agrium (ticker: AGU), although only a semi-annual payer, hit the grandslam with a 309% increase, taking it’s annual payout from $.11 to $.45/share. Unfortunately, even after these monster increases, both of these shares are still yielding well below 1%.

Special Notes

This week’s stock of special note is Franklin Resources (ticker: BEN). While Franklin did raise their dividend this week 8% to $1.08, they also announced a special dividend of $2/share which brings the annualized yield on this stock to just over 3%

For more detailed information about all of today’s dividend increases please refer to the chart below.

Investment Considerations

As always when evaluating investment opportunities it’s important to keep in mind not only the fundamentals of the stock itself, but also how the holding entity (Limited Partnership,Royalty Trust, Master Limited Partnership, Business Development Company, Preferred Stock) may affect the way you report income on your annual tax return as well as the amount or percentage of tax you will be required to pay. Adding shares of any of these special entities to tax deferred / retirement accounts may also present additional issues.

the fundamentals of the stock itself, but also how the holding entity (Limited Partnership,Royalty Trust, Master Limited Partnership, Business Development Company, Preferred Stock) may affect the way you report income on your annual tax return as well as the amount or percentage of tax you will be required to pay. Adding shares of any of these special entities to tax deferred / retirement accounts may also present additional issues.

Remember to review all of the fundamentals of any company BEFORE investing – do not simply buy a stock based on the dividend payout. If you have further questions about any stock mentioned her you should first consult with your CPA or tax planner / advisor before making any investments.

January is definitely off to a slow start as far as dividend increases go. This week only two companies reported dividend increases including an industrial machinery & goods company, Robbins & Myers (ticker: RBN) as well as Plains All American Pipeline, LP (ticker: PAA) an oil and natural gas pipeline management firm.

January is definitely off to a slow start as far as dividend increases go. This week only two companies reported dividend increases including an industrial machinery & goods company, Robbins & Myers (ticker: RBN) as well as Plains All American Pipeline, LP (ticker: PAA) an oil and natural gas pipeline management firm.